The ParentPay App has transformed how schools and parents handle payments, shifting from cumbersome cash transactions to a seamless, digital solution. By simplifying the process of paying for school meals, trips, and other expenses, ParentPay has become a trusted platform across the UK.

In this comprehensive guide, we will explore everything from the app’s key features to its benefits, recent updates, and tips for maximising its use. Whether you’re a parent or a school administrator, this guide will help you navigate the world of cashless school payments effortlessly.

What Is the ParentPay App?

The ParentPay App is a secure, online payment platform designed specifically for schools. It allows parents to make cashless payments for various school-related expenses, such as meals, trips, uniforms, and clubs.

The app connects directly to the school’s account, creating a digital bridge that ensures quick, easy, and safe transactions between parents and schools.

How Does the ParentPay App Work?

The ParentPay App is designed to make school payments simple and efficient. Here’s a step-by-step guide to help you understand how the app works:

Step 1: Receive Activation Details from the School

Image – Source

- Your child’s school will provide you with a unique activation code. This code is essential to set up your ParentPay account and link it with the school.

Step 2: Create Your ParentPay Account

Image – Source

- Visit the ParentPay website or open the ParentPay app on your smartphone.

- Click on “Login” and then select “Activate Account.”

- Enter the activation code provided by the school and fill in your personal details, including your email address and a secure password.

- Confirm your details to create your account.

Step 3: Add Your Child’s Details

Image – Source

- Once logged in, go to the “Add a Child” section.

- Enter your child’s details, such as name, class, and the unique pupil number (if required).

- This step links your account to your child’s school account, allowing you to manage their school payments.

Step 4: Navigate the ParentPay Dashboard

Image – Source

- The dashboard is your control center, showing all pending payments, recent transactions, and account settings.

- Explore the dashboard to understand the different sections, including “To Pay,” “Payment History,” and “Communication.”

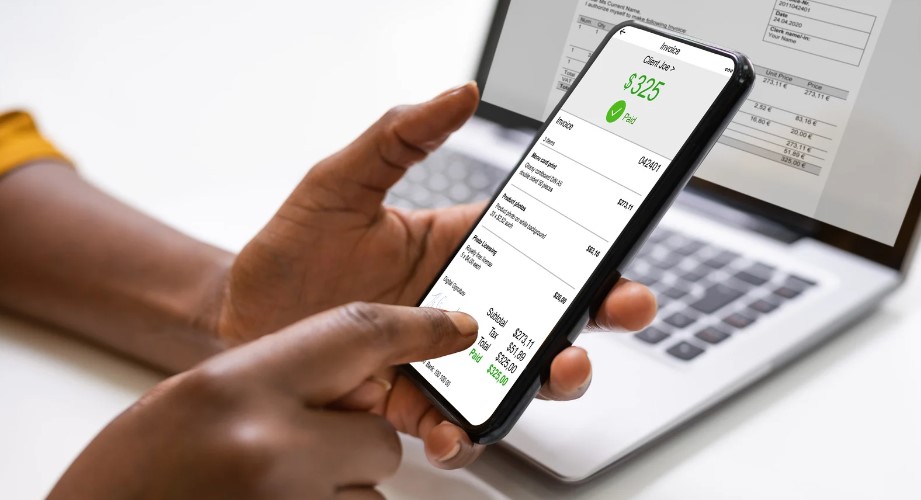

Step 5: Make a Payment

Image – Source

- In the “To Pay” section, select the payment item (e.g., school meals, trips, or extracurricular activities) you wish to pay for.

- Choose your preferred payment method (credit/debit card, PayPoint, or direct bank transfer).

- Enter the payment details and click “Confirm” to complete the transaction.

- A digital receipt will be generated and saved in your account for future reference.

Step 6: Set Payment Alerts and Notifications

- Enable payment alerts in the app settings to receive real-time notifications for upcoming payments, due dates, and transaction confirmations.

- This feature helps you stay on top of all school-related expenses and avoids missed payments.

Step 7: Monitor and Manage Transactions

- Use the “Payment History” section to monitor all transactions, view receipts, and check your current balance.

- You can also download transaction statements for record-keeping or dispute resolution.

Step 8: Contact Support if Needed

- If you experience any issues, access the “Help” section within the app to find answers to common questions or to contact customer support directly.

Step 9: Log Out Securely

- Always log out after completing your transactions to ensure your account remains secure.

By following these steps, you can efficiently manage your child’s school payments through the ParentPay App, ensuring a hassle-free and secure payment experience.

What Are the Key Features of the ParentPay App?

The ParentPay App offers several standout features that make it an ideal choice for school payments:

- Cashless Payments: The app supports various cashless payment methods, including credit/debit cards, bank transfers, and PayPoint, providing flexibility to parents.

- User-Friendly Interface: With its clean design and intuitive navigation, the app is easy to use, even for those who aren’t tech-savvy. Parents can quickly find their child’s details, view outstanding payments, and complete transactions in a few clicks.

- Secure Transactions: ParentPay uses advanced encryption technology to protect users’ data and financial information. With two-factor authentication and GDPR compliance, the app ensures the highest security standards.

- Real-Time Notifications and Updates: Parents receive instant alerts for due payments, new expenses, and confirmations for completed transactions. These notifications help parents stay organised and avoid missed payments.

- Multi-Child Management: For parents with multiple children, the app offers a consolidated view, allowing them to manage payments for all their children from a single account.

By leveraging these features, parents and schools can experience a streamlined payment process that reduces administrative burdens and enhances financial transparency.

Why Should You Use ParentPay for School Payments?

Choosing ParentPay offers multiple benefits for both parents and schools:

- Convenience for Parents and Schools: For parents, ParentPay provides a single platform to manage all school payments, eliminating the hassle of sending cash or cheques. Schools benefit from streamlined payment processing, reduced paperwork, and improved financial management.

- Reducing Cash Handling and Administration: Handling cash is not only time-consuming but also risky. ParentPay eliminates the need for cash, reducing the administrative burden and enhancing security.

- Enhanced Security and Transparency: ParentPay ensures that all transactions are secure and traceable. The app provides a detailed log of all payments, which can be accessed by both parents and schools at any time, ensuring complete transparency.

How Does the ParentPay App Support Schools?

The ParentPay App offers several features that specifically support schools in managing their finances more effectively:

Managing School Funds Efficiently

- Automating Payment Tracking: The app automatically records all payments made by parents, reducing manual errors and saving time for school administrators.

- Providing Financial Reporting Tools: Schools can generate comprehensive financial reports to track income and expenses, helping them manage their budgets more effectively.

- Enabling Custom Payment Categories: Schools can create custom payment categories (such as field trips, lunch fees, or school clubs) to organise funds better.

Reducing Administrative Burden

By automating payment processes and reducing cash handling, the app frees up staff time, allowing them to focus on other critical tasks.

Improving Communication with Parents

ParentPay serves as a direct communication channel between schools and parents. Schools can send payment reminders, updates, and other important messages directly through the app, ensuring timely communication.

What Are the Top Tips for Getting the Most Out of ParentPay?

To maximise the benefits of the ParentPay App, consider the following tips:

- Keeping Your Account Secure: Regularly update your password and enable two-factor authentication to protect your account from unauthorised access.

- Setting Payment Reminders: Use the app’s built-in notification feature to set reminders for upcoming payments. This will help you avoid late fees and keep your child’s account in good standing.

- Tracking Transaction History: Make it a habit to regularly check your transaction history to verify all payments and monitor your spending. This practice can help identify any discrepancies early on.

What Are the Recent Updates and Enhancements to the ParentPay App?

ParentPay is continually improving its app to serve its users better. Here are some of the recent updates:

- New Features and Functionality: Recent updates have introduced faster load times, a more intuitive user interface, and additional payment options such as direct bank transfers.

- Improved User Experience and Performance: The app now offers a smoother, more responsive experience, thanks to backend optimisations and bug fixes.

- Upcoming Updates to Look Out For: Future updates will include personalised dashboards for easier navigation, expanded customer support options, and enhanced financial reporting tools.

How Can You Troubleshoot Common Issues with the ParentPay App?

If you encounter any problems while using the ParentPay App, follow these steps to resolve them:

- How to Resolve Login Problems: Ensure that your device is connected to a stable internet source and that you are entering the correct login credentials. Try changing your password or reinstalling the app if the problem continues.

- Fixing Payment Errors: Double-check your payment details, such as card information and billing address. If the problem continues, consider using a different payment method or contacting ParentPay support.

- Accessing Customer Support: The app has a dedicated help section where you can find answers to common questions. You can also visit the ParentPay website to access further support resources or contact customer service directly.

What Are the Alternatives to the ParentPay App?

While ParentPay is one of the leading school payment platforms, several alternatives are available:

- SchoolMoney: Offers similar features to ParentPay, including online payments, reporting tools, and parental communication channels. However, some users find it less intuitive.

- Wisepay: Known for its robust security features and comprehensive support for various payment methods, but it can be more expensive for schools.

- Tucasi: A popular choice for smaller schools due to its simplicity and lower cost, but it lacks some advanced features available in ParentPay.

Every one of these options has advantages and disadvantages. Schools should evaluate their specific needs and budget before choosing a platform.

How Does ParentPay Handle Data Privacy and Security?

Data security is a critical concern for any online payment platform, and ParentPay takes it seriously:

- Advanced Encryption: The app uses state-of-the-art encryption technology to protect sensitive information, including personal and financial data.

- GDPR Compliance: ParentPay adheres to the General Data Protection Regulation (GDPR), ensuring that all data is collected, stored, and processed securely.

- Regular Security Audits: The platform undergoes regular security audits to identify and fix any vulnerabilities, ensuring that users’ data is always protected.

How Can Schools Implement ParentPay Effectively?

Schools looking to implement ParentPay should consider the following strategies:

- Engage with Parents Early: Provide parents with clear information about ParentPay’s benefits and how to use it. Offering demonstrations or information sessions can help address any concerns and encourage adoption.

- Offer Training for Staff: Ensure that administrative staff are well-trained in using the ParentPay platform. This includes understanding how to set up accounts, manage payments, and generate reports. Adequate training will help staff handle any queries or issues that arise from parents.

- Monitor Feedback and Make Adjustments: Regularly gather feedback from both parents and staff to identify any challenges or areas for improvement. Adjust the implementation process accordingly to enhance user experience.

- Integrate ParentPay with Existing School Systems: Where possible, integrate ParentPay with other school management systems to streamline operations and reduce redundant work. This can help create a more cohesive approach to handling school payments.

How Can Parents Resolve Payment Discrepancies?

Occasionally, parents may encounter payment discrepancies. Here are steps to resolve them:

- Check Transaction History: The first step is to review your transaction history in the app. Look for any anomalies, such as duplicate charges or incorrect amounts.

- Contact the School Directly: If the discrepancy appears to be related to a specific school-related payment (e.g., a field trip or lunch fees), contact the school’s finance office to clarify and resolve the issue.

- Use ParentPay Customer Support: If the issue is not resolved through the school, or if it appears to be a technical problem with the app, reach out to ParentPay’s customer support team. They can assist with investigating the issue and providing solutions.

What Are Some Common Misconceptions About ParentPay?

There are a few common misconceptions about ParentPay that need to be clarified:

- “ParentPay Charges Parents Fees”: ParentPay does not charge parents for using its services. However, some specific payment methods (like credit cards) may incur processing fees from financial institutions.

- “ParentPay Is Only for Large Schools”: While ParentPay is widely used by larger schools, it is also suitable for smaller schools and even nurseries. The platform can be customised to meet the needs of any educational institution.

- “ParentPay Is Complicated to Use”: The app is designed to be user-friendly, with a clean interface and straightforward navigation. Even those with limited tech experience find it easy to set up and use.

How Can Schools Maximise the Benefits of ParentPay?

Schools can maximise the benefits of ParentPay by:

- Regularly Updating Payment Categories: Keep the payment categories up-to-date to reflect all current activities, trips, and fees. This makes it easier for parents to find and pay for specific items.

- Encouraging Early Adoption: Encourage parents to register and start using ParentPay at the beginning of the school year to avoid delays in payments and ensure smooth financial management throughout the year.

- Offering Support Resources: Provide easy access to tutorials, FAQs, and customer support details to help parents and staff navigate the platform.

Conclusion

The ParentPay App provides an efficient, secure, and user-friendly solution for managing school payments. With its comprehensive features, ease of use, and strong commitment to data security, it has become a preferred choice for many schools and parents in the UK.

By adopting ParentPay, schools can streamline their administrative processes, reduce cash handling, and enhance their relationship with parents, while parents enjoy a hassle-free payment experience that keeps them in control of their child’s school expenses.

For those looking to embrace the future of school payments, ParentPay offers an ideal platform to start.

Frequently Asked Questions (FAQs)

How secure is the ParentPay App?

The ParentPay App uses advanced encryption and security protocols to ensure that all transactions are safe and secure.

Can I use ParentPay on multiple devices?

Yes, you can access your ParentPay account on multiple devices, such as smartphones, tablets, and computers.

What payment methods does ParentPay accept?

ParentPay accepts a variety of payment methods, including credit/debit cards, PayPoint, and direct bank transfers.

Is there a fee for using ParentPay?

No, there is no fee for parents to use ParentPay; however, some payment methods may incur charges.

How do I change my personal details on ParentPay?

Log into your account, go to ‘My Profile,’ and update your personal information as needed.

What should I do if I forget my password?

Click on the ‘Forgotten Password’ link on the login page and follow the instructions to reset your password.

How do I contact ParentPay customer support?

Visit the ParentPay website or use the app’s support section to find the appropriate contact details for customer support.

Disclaimer

The images used in the above blog is not owned by UK Startup Blog and the copyrights of those images belong to the respective owners only.