Managing personal finances can be challenging, but using the right tools, like a 0% balance transfer credit card, can ease the burden of paying off existing debts. These cards allow you to transfer the balance from one or more credit cards and pay it down without incurring interest during the promotional period.

This guide presents the best 0% balance transfer credit cards available in the UK, explaining how they work and what you need to consider to maximise your savings and manage debt effectively.

What Is a 0% Balance Transfer Credit Card?

A 0% balance transfer credit card offers a period during which no interest is charged on balances transferred from other credit cards. This allows you to reduce debt without paying interest for a set time, which usually ranges from 12 to 30 months.

The key benefit is that you can focus on paying off your debt without accruing interest. After the promotional period ends, the card’s standard APR comes into play, which is often much higher. Therefore, paying off the entire balance during the 0% interest period is crucial to avoid significant charges later.

Advantages of 0% Balance Transfer Cards

- Interest-Free Debt Repayment: Pay off your balance without interest accumulating, allowing for faster debt reduction.

- Lower Fees: Transfer fees tend to be lower than what you would pay in interest over the same period on a regular credit card.

- Single Monthly Payment: Consolidating debts into one card means you only have to manage one payment each month, simplifying your finances.

How Does a 0% Balance Transfer Card Work?

The concept behind a 0% balance transfer card is simple. You transfer debt from an existing card (or multiple cards) to a new one, which offers an interest-free period.

This period typically lasts anywhere from 12 to 30 months, giving you time to reduce or clear your debt without worrying about additional interest charges. However, a balance transfer fee usually applies, ranging between 1% and 3% of the amount transferred.

Once the interest-free period ends, the card’s standard APR is applied to any remaining balance, which can be considerably high, often around 20-25%. Therefore, the goal is to pay off the entire balance before the 0% period expires.

Who Should Consider a 0% Balance Transfer Credit Card?

A 0% balance transfer card is ideal for individuals who want to manage their debt more effectively or consolidate balances from multiple credit cards. These cards are especially beneficial if you have high-interest debt and want a clear path to reducing it without accruing additional interest.

This option is particularly suited for:

- Debt consolidators: If you have high-interest credit card debt spread across multiple accounts, moving it to a single card with a 0% interest offer can simplify payments and lower overall costs.

- Planners: Those who can commit to paying off the balance within the interest-free period can save significantly on interest payments.

- Budget-conscious individuals: If you’re managing large purchases or unexpected expenses, using a balance transfer card can help you avoid paying interest while spreading costs over several months.

What are the Potential Risks of Using 0% Balance Transfer Credit Cards?

While 0% balance transfer cards can be incredibly beneficial, they also come with potential pitfalls if not used carefully:

High APR After the Promotional Period

Once the interest-free period ends, the remaining balance will be subject to the card’s standard APR, which is often much higher than regular credit cards. If you haven’t cleared the balance by this time, the interest on the remaining debt can accumulate quickly. For instance, most cards revert to an APR of around 20-25% once the promotional period ends.

Transfer Fees

Many balance transfer cards charge a balance transfer fee, typically between 1-3% of the amount being transferred. This means if you transfer £2,000 with a 3% fee, you’ll pay an additional £60 upfront. While this is still lower than ongoing interest on many standard credit cards, it’s important to account for these fees when calculating potential savings.

Impact on Credit Score

Applying for a new credit card can temporarily lower your credit score due to the hard inquiry by the card issuer. Additionally, using too much of your available credit or missing payments can have a long-term impact on your credit rating.

Losing Promotional Offer

If you miss even one monthly payment, most credit card companies will remove your 0% interest offer and apply the standard APR immediately. This makes timely payments essential.

Temptation to Overspend

The allure of 0% interest can sometimes lead to overspending. It’s easy to make purchases thinking you have plenty of time to pay them off, but if you’re not careful, you could find yourself with more debt than before.

Top 9 0% Balance Transfer Credit Cards in the UK

1. HSBC Balance Transfer Credit Card

With the HSBC Balance Transfer Credit Card, you can enjoy up to 29 months of 0% interest on balance transfers, making it an excellent choice for long-term debt management. Here are the key details:

- 0% interest period: Up to 29 months on balance transfers.

- Transfer fee: 3.49% (minimum £5 per transfer).

- Representative APR: 24.9% APR (variable) after the promotional period.

- Best for: Longest interest-free period on balance transfers and simplifying debt management by consolidating multiple credit card balances into one.

To qualify for the full 29 months interest-free, balance transfers must be made within the first 60 days of opening the account. This card allows you to consolidate your debt into one easy monthly payment, but it’s important to keep in mind the 3.49% transfer fee.

Representative Example:

- Purchase rate: 24.9% p.a. (variable)

- Representative APR: 24.9% APR (variable), based on a credit limit of £1,200.

This card is ideal for those looking for an extended 0% interest period to pay off debt without accruing additional interest. However, remember to pay off as much as possible before the promotional period ends to avoid the higher standard APR.

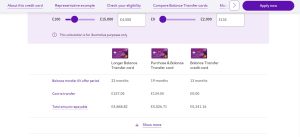

2. NatWest Longer Balance Transfer Card

The NatWest Longer Balance Transfer Card is designed for individuals who need more time to pay off their balance, offering an extended interest-free period. This card allows you to transfer balances from one or more existing cards and enjoy up to 23 months of 0% interest on balance transfers.

- 0% interest period: 23 months on balance transfers.

- Transfer fee: 3.49% (no annual fee).

- Additional benefit: 0% interest on purchases for the first 3 months, ideal for making short-term purchases while paying down debt.

- Representative APR: 24.9% APR (variable) after the promotional period.

To make the most of this card, balance transfers must be completed within 3 months of account opening. After the promotional period ends, the standard APR of 24.9% (variable) applies to any remaining balance or new purchases.

Good For:

- Those who need more time to pay off their debts, especially with the extended 23-month 0% interest period.

- People making short-term purchases, with the added benefit of 3 months of interest-free purchases.

Representative Example:

- Purchase rate: 24.9% p.a. (variable)

- Representative APR: 24.9% APR (variable), based on a credit limit of £1,200.

- Annual fee: £0.

The NatWest Longer Balance Transfer Card is a solid choice for those looking to consolidate debt with plenty of time to pay it off without interest. It’s especially useful for individuals with larger balances who require an extended period to manage repayments.

3. Barclays Platinum Balance Transfer Card

The Barclays Platinum Balance Transfer Card is an excellent option for individuals looking for a long balance transfer period, with up to 28 months of 0% interest on transfers. This card provides a manageable way to consolidate your debts, though a 3.45% transfer fee applies.

- 0% interest period: Up to 28 months on balance transfers.

- Transfer fee: 3.45% (applies to each balance transfer made).

- Additional benefit: 0% interest on purchases for the first 3 months, ideal for short-term spending while focusing on debt repayment.

- Representative APR: 24.9% APR (variable) after the promotional period.

To take full advantage of the 0% balance transfer offer, transfers must be made within 60 days of opening the account. After the promotional period, any remaining balance will be charged the standard APR of 24.9% (variable).

Representative Example:

- Purchase rate: 24.9% p.a. (variable).

- Representative APR: 24.9% APR (variable), based on a credit limit of £1,200.

Good For:

- Individuals who need an extended 28-month interest-free period to pay down debt.

- People who want to combine balance transfers with short-term purchases interest-free for the first three months.

The Barclays Platinum Balance Transfer Card is one of the top picks for managing debt over an extended period, but it’s important to consider the 3.45% transfer fee when calculating overall savings.

4. Tesco Bank Balance Transfer Credit Card

The Tesco Bank Balance Transfer Credit Card is a great choice for individuals looking to transfer existing credit card or store card balances while also earning rewards. It offers up to 27 months of 0% interest on balance transfers and allows you to collect Clubcard points for additional savings on future purchases.

- 0% interest period: 27 months on balance transfers.

- Transfer fee: 2.95% (applies to balance transfers made within the first 90 days).

- Additional benefit: 0% interest on money transfers for the first 9 months (with a 3.99% fee for money transfers).

- Rewards: Earn Clubcard points almost every time you spend, both in and out of Tesco.

- Representative APR: 24.9% APR (variable) after the promotional period.

This card not only helps manage debt with a long 0% balance transfer period but also allows for money transfers to your bank account, giving more flexibility in managing your finances. It’s important to note that balance transfers need to be made within 90 days to benefit from the promotional 0% interest rate.

Good For:

- People looking to consolidate debt while earning rewards for everyday spending.

- Those interested in a long interest-free period for both balance and money transfers.

Representative Example:

- Purchase rate: 24.9% p.a. (variable).

- Representative APR: 24.9% APR (variable), based on a credit limit of £1,200.

The Tesco Bank Balance Transfer Credit Card offers excellent value with its long 0% period and added rewards through Clubcard points, making it a smart option for Tesco shoppers looking to combine debt management with rewards.

5. Lloyds Bank Balance Transfer Card

The Lloyds Bank Balance Transfer Credit Card provides a simple and effective way to consolidate debt by transferring balances from other credit or store cards. With up to 27 months of 0% interest on balance transfers, this card helps you reduce debt without worrying about interest accumulating during the promotional period.

- 0% interest period: 27 months on balance transfers.

- Transfer fee: 3.2% (applies to each balance transfer made).

- Representative APR: 24.9% APR (variable) after the promotional period.

Lloyds Bank allows multiple balance transfers (minimum £100 per transfer), so you can consolidate debts from various cards into one manageable payment. However, transfers must be made from cards outside the Lloyds Bank group, and fees apply based on the amount transferred.

Good For:

- People seeking a long-term solution for debt repayment with a 27-month interest-free period.

- Those who want to manage their finances better by consolidating multiple credit card debts into one.

Representative Example:

- Purchase rate: 24.9% p.a. (variable).

- Representative APR: 24.9% APR (variable), based on a credit limit of £1,200.

This card provides a manageable way to transfer and pay off balances over an extended period, although the 3.2% transfer fee means it’s important to calculate the savings from the interest-free period versus the cost of the transfer.

6. Santander Everyday Long-Term Credit Card

The Santander Everyday Long-Term Credit Card offers an extended period of 26 months of 0% interest on balance transfers, making it a strong option for consolidating and paying off debt over time. With no monthly account fee, this card simplifies debt management by allowing you to transfer multiple balances and make a single, manageable monthly payment.

- 0% interest period: 26 months on balance transfers.

- Transfer fee: 3% (minimum £5 per transfer).

- Additional benefit: 0% interest on purchases for the first 3 months.

- Representative APR: 23.9% APR (variable) after the promotional period.

This card is an excellent choice for anyone looking to transfer large balances and repay debt interest-free over a long period. Additionally, the card offers 3 months of 0% interest on purchases, making it flexible for short-term spending as well.

What You Need to Apply:

- Be at least 18 years old and a permanent UK resident.

- Have an annual income of £10,500 or more.

- You must not already have another Santander Everyday credit card.

Representative Example:

- Purchase rate: 23.9% p.a. (variable).

- Representative APR: 23.9% APR (variable), based on a credit limit of £1,200.

- Monthly fee: £0.

The Santander Everyday Long-Term Credit Card is perfect for individuals seeking an extended interest-free period to repay balances and simplify their monthly payments without the hassle of annual fees.

7. MBNA No-Fee Balance Transfer Credit Card

The MBNA No-Fee Balance Transfer Credit Card stands out for its no transfer fee, making it a cost-effective choice for those who want to transfer balances without upfront costs. With 21 months of 0% interest on balance transfers, this card helps you pay down debt interest-free over nearly two years.

- 0% interest period: 21 months on balance transfers.

- Transfer fee: 3.49%.

- Additional benefit: 0% interest on purchases for 21 months.

- Representative APR: 24.9% APR (variable) after the promotional period.

This card is ideal for individuals who want to consolidate debt without incurring any initial transfer fee. The 21-month 0% interest period on both balance transfers and purchases adds flexibility, allowing cardholders to spread the cost of purchases while managing existing debts.

Representative Example:

- Purchase rate: 24.94% p.a. (variable).

- Representative APR: 24.9% APR (variable), based on a credit limit of £1,200.

With no balance transfer fee and a substantial interest-free period, the MBNA No-Fee Balance Transfer Credit Card is one of the most budget-friendly options for those seeking to clear their debts without additional costs.

8. Virgin Money Balance Transfer Credit Card

The Virgin Money Balance Transfer Credit Card offers one of the longest interest-free periods available, providing 0% interest on balance transfers for up to 29 months. This card is an excellent choice for those looking to spread the cost of debt repayments over a longer period, with the added flexibility of consolidating multiple balances into one.

- 0% interest period: Up to 29 months on balance transfers.

- Transfer fee: Fees apply (specific terms will vary based on your offer at the time of application).

- Representative APR: 24.9% APR (variable) after the promotional period.

This card gives cardholders a significant period to repay transferred balances interest-free, making it one of the top choices for long-term debt management. However, be mindful of the balance transfer fee, which can vary, and the 24.9% APR that applies after the promotional period.

Representative Example:

- Purchase rate: 24.9% p.a. (variable).

- Representative APR: 24.9% APR (variable), based on a credit limit of £1,200.

The Virgin Money Balance Transfer Credit Card is ideal for individuals seeking a long-term interest-free period to manage large balances, offering flexibility in repaying debt while avoiding interest for up to 29 months.

9. HSBC Purchase Card

The HSBC Purchase Card is an all-rounder, offering both interest-free purchases for up to 20 months and 0% interest on balance transfers for up to 17 months. This makes it ideal for those who want to spread the cost of new purchases or consolidate existing debt while avoiding interest for an extended period.

- 0% interest period: Up to 20 months on purchases and 17 months on balance transfers.

- Transfer fee: 3.49% (minimum £5 per transfer).

- Representative APR: 24.9% APR (variable) after the promotional period.

With this card, you can manage both new purchases and transferred balances, providing flexibility to cover multiple financial needs. To make the most of the 0% balance transfer offer, transfers must be completed within the first 60 days of account opening.

Good For:

- Those wanting to spread the cost of purchases interest-free over 20 months.

- Individuals who want to consolidate debt with 17 months of 0% interest on balance transfers.

Representative Example:

- Purchase rate: 24.9% p.a. (variable).

- Representative APR: 24.9% APR (variable), based on a credit limit of £1,200.

The HSBC Purchase Card is a great option for shoppers who want to finance large purchases without incurring interest, while also benefiting from balance transfer options. However, be mindful of the 3.49% transfer fee on balances and ensure that transfers are made within the first 60 days to take full advantage of the offer.

Here’s a table summarizing the top 9 0% balance transfer credit cards for long-term savings, featuring key details such as the interest-free periods, transfer fees, and APR for each card:

| Credit Card | 0% Transfer Period | Transfer Fee | 0% Purchase Period | Representative APR (Variable) | Key Benefits |

| HSBC Balance Transfer Credit Card | Up to 29 months | 3.49% (min £5) | N/A | 24.9% | Longest interest-free period with no annual fee. |

| NatWest Longer Balance Transfer Card | Up to 23 months | 3.49% | 3 months | 24.9% | Long interest-free period on both balance transfers & purchases. |

| Barclays Platinum Balance Transfer Card | Up to 28 months | 3.45% | 3 months | 24.9% | Includes Barclaycard Entertainment perks for added value. |

| Tesco Bank Balance Transfer Credit Card | Up to 27 months | 2.95% | 9 months (money transfer) | 24.9% | Earn Clubcard points on spending and long transfer period. |

| Lloyds Bank Balance Transfer Card | Up to 27 months | 3.2% | N/A | 24.9% | Offers a long transfer period and easy balance management. |

| Santander Everyday Long-Term Credit Card | Up to 26 months | 3% | 3 months | 23.9% | No monthly fee, with cashback offers via Santander Boosts. |

| MBNA No-Fee Balance Transfer Credit Card | Up to 21 months | None | 21 months | 24.9% | No transfer fee and 0% on purchases and transfers. |

| Virgin Money Balance Transfer Credit Card | Up to 29 months | 2.99% | N/A | 24.9% | Longest balance transfer period, great for large balances. |

| HSBC Purchase Card | Up to 17 months | 3.49% (min £5) | 20 months | 24.9% | Combines balance transfer and purchase offers. |

This table highlights the important features of each credit card, helping you choose the one that best fits your financial goals.

Conclusion

Choosing the right 0% balance transfer credit card can make a significant difference in your debt repayment strategy. These cards provide interest-free periods that allow you to consolidate balances, simplify payments, and reduce overall debt without incurring extra interest during the promotional period.

Each card offers unique benefits from extended interest-free periods to rewards programs, so it’s essential to consider factors like balance transfer fees, the length of the 0% interest period, and additional perks such as purchase offers or cashback options.

The cards featured in this guide provide some of the best 0% balance transfer options in the UK, each tailored to different financial needs. Whether you need extra time to pay off large balances, want to avoid fees, or seek to earn rewards on everyday spending, there’s a card here for you.

Remember, the key to maximizing savings is to pay off as much of your balance as possible before the promotional period ends and to avoid overspending. By choosing wisely and managing your debt responsibly, you can take control of your finances and move closer to long-term financial stability.

Frequently Asked Questions (FAQ)

What is a 0% balance transfer credit card?

A 0% balance transfer credit card allows you to move existing debt from one or more credit cards to a new card that offers an interest-free period for a set number of months. During this time, no interest will be charged on the transferred balance, allowing you to pay off your debt more efficiently.

How long is the typical 0% balance transfer period?

The 0% interest period on balance transfers typically lasts between 12 and 30 months, depending on the card. The longer the period, the more time you have to repay the debt without interest. For example, the Virgin Money Balance Transfer Credit Card offers up to 29 months, one of the longest interest-free periods available.

Can I transfer multiple balances to a single 0% balance transfer card?

Yes, many credit cards, such as the Santander Everyday Long-Term Credit Card, allow you to transfer multiple balances from different cards. This can help simplify your payments by consolidating all your debts into one manageable monthly payment.

What happens if I don’t pay off my balance before the 0% interest period ends?

After the promotional 0% interest period ends, any remaining balance will be subject to the card’s standard APR, which can be between 20-25% depending on the card. It’s important to pay off as much of the balance as possible before the interest-free period expires to avoid these higher interest charges.

Are there any fees associated with balance transfers?

Yes, most balance transfer credit cards charge a balance transfer fee, typically between 1-3% of the amount transferred. For instance, the HSBC Balance Transfer Credit Card charges a 3.49% transfer fee. Some cards, like the MBNA No-Fee Balance Transfer Card, do not charge a fee, but the 0% interest period may be shorter.

Can I still make purchases with a 0% balance transfer credit card?

Yes, you can make purchases with most balance transfer credit cards. Some cards, like the HSBC Purchase Card, offer 0% interest on purchases for a set period (e.g., up to 20 months). However, if the card doesn’t offer 0% interest on purchases, any new purchases will likely accrue interest at the card’s standard rate.

Will a balance transfer affect my credit score?

Opening a new balance transfer card can temporarily affect your credit score due to the hard inquiry from the credit card issuer. However, responsibly managing your balance and making on-time payments can improve your score in the long term by reducing your credit utilization ratio and demonstrating good payment behavior.