If you’ve ever struggled with poor credit, you’re well aware of how difficult it can be to secure a credit card. Rejections from mainstream lenders can be frustrating, especially when you need access to credit for essential purchases or emergencies.

Fortunately, guaranteed approval credit cards provide a lifeline for individuals in the UK with bad credit or no credit history. These cards offer an accessible path for those aiming to rebuild their financial reputation, despite previous setbacks.

In this comprehensive guide, we’ll explore the top 10 guaranteed approval credit cards for bad credit in the UK, outline their key features, and show you how these cards can help you regain control over your financial future.

What Are Guaranteed Approval Credit Cards?

Guaranteed approval credit cards are designed specifically for individuals with poor credit or no credit history. Unlike traditional credit cards, which heavily rely on your credit score for approval, these cards focus less on your past financial performance.

They aim to provide a second chance for people who need credit but have struggled with managing it in the past. While the name “guaranteed approval” might sound like a 100% assurance, it’s important to note that you must still meet basic criteria, such as being a UK resident, meeting the age requirement (usually 18 or over), and having a source of income.

Additionally, these cards come with trade-offs: expect higher interest rates, lower credit limits, and fewer perks compared to premium cards.

Who Can Benefit from Guaranteed Approval Credit Cards?

These types of credit cards are especially beneficial for individuals who fall into the following categories:

- Low or Poor Credit Score Holders: If you have a history of late payments, defaults, or bankruptcies, these cards offer a chance to rebuild your credit score.

- No Credit History: Young adults or individuals new to the UK who have no credit history can also benefit from these cards as they provide an opportunity to establish a credit record.

- Rejection from Traditional Lenders: If you’ve been turned down by mainstream credit card providers, guaranteed approval cards offer a reliable alternative.

- Credit Rebuilders: For those actively working to improve their credit scores, these cards provide a practical stepping stone.

These cards allow people in financially difficult situations to access essential credit, which can be used to manage everyday expenses, emergencies, or even planned purchases.

How Do Guaranteed Approval Cards Impact Your Credit Score?

The primary purpose of guaranteed approval credit cards is to help individuals improve their credit score. When used correctly, these cards can have a positive impact on your credit report, making it easier to access better financial products in the future.

To use these cards to boost your credit score:

- Pay on Time: Payment history is a major factor in your credit score. Ensure that you make at least the minimum payment on time each month.

- Keep Your Credit Utilisation Low: A good rule of thumb is to use no more than 30% of your available credit limit. This demonstrates that you’re responsible with credit and aren’t dependent on it.

- Monitor Your Credit Report: Use tools offered by some credit card providers to track changes in your credit score and keep an eye out for inaccuracies or areas of improvement.

However, missing payments or using too much of your credit limit can have the opposite effect, further damaging your credit. It’s crucial to manage these cards responsibly to see positive long-term effects.

Key Features to Look For in a Credit Card for Bad Credit

When choosing a credit card for bad credit, it’s essential to compare key features to ensure you’re getting the best option for your needs. Here’s what to look out for:

- Interest Rates: Credit cards for bad credit typically come with higher interest rates compared to standard cards. Pay close attention to the APR (Annual Percentage Rate) to understand the cost of borrowing, especially if you plan to carry a balance.

- Fees: Some cards come with annual fees, while others might charge for late payments or overseas transactions. Compare cards with no or low fees to reduce your overall costs.

- Credit Limit: Most bad credit credit cards have lower credit limits, starting around £200. While this may seem restrictive, it’s beneficial for staying within a responsible borrowing range.

- Secured vs. Unsecured: Secured credit cards require a deposit, which acts as collateral and can result in better terms. Unsecured cards don’t require a deposit but may come with higher interest rates or stricter usage conditions.

- Credit Monitoring: Some cards offer free credit report tracking and alerts, which can help you monitor your progress as you work on improving your credit score.

Top 9 Guaranteed Approval Credit Cards for Bad Credit in the UK

Now, let’s dive into the top 10 guaranteed approval credit cards for bad credit in the UK. Each of these cards offers a unique set of benefits aimed at helping individuals rebuild their credit while maintaining access to essential financial services.

1. Aqua Classic Card

Aqua is a popular option for individuals looking to rebuild their credit. The Aqua Classic Card offers a simple and reliable way to improve your credit score while providing the support and tools needed to manage your finances effectively. Designed with those in mind who may have been turned down elsewhere, Aqua gives you the opportunity to build better credit over time.

- Representative APR: 34.9% (variable)

- Credit Limit: Adjusts as Aqua gets to know your spending habits, with potential increases for responsible use.

Key Features:

- Safe and Secure: With 24/7 fraud protection, Aqua ensures your account is safeguarded, and their friendly customer support team is available whenever you need assistance.

- Personalised Credit Limits: Aqua adjusts your credit limit as you build trust through responsible account management, rewarding you with potential credit increases over time.

- Expert Support and Tools: Aqua provides free credit score updates and access to credit-building tools through its mobile app, empowering you to track and improve your credit.

Aqua’s approach is geared towards providing a safe and structured environment for individuals with bad credit, making it easier to gain control over your financial health.

2. Zable Credit Card

The Zable Credit Card offers a straightforward and user-friendly way to build your credit score. With the ability to check eligibility without impacting your credit score, it’s designed to make the process as simple as possible. Zable’s mobile app also allows for easy money management, providing a seamless experience for cardholders.

- Representative APR: 34.9% (variable)

- Credit Limit: £300 – £1,500

Key Features:

- Boost Approval Odds: Zable allows you to use your banking history to improve your approval chances by up to 35%.

- Instant Spending: Most customers can start using their Zable Credit Card immediately with Apple Pay or Google Pay, adding convenience to their shopping experience.

- Build Credit Responsibly: By making on-time payments and staying within your credit limit, the Zable Credit Card can help improve your credit score over time.

Zable offers a no-fuss approach to credit rebuilding, with its intuitive app and focus on credit management, making it a great option for individuals looking for simplicity and efficiency.

3. Ocean Finance Credit Card

Ocean Finance offers a reliable credit card for those looking to rebuild their financial health. With a free eligibility check and a quick response time, this card is ideal for individuals who want to apply with confidence without impacting their credit score.

- Representative APR: 39.9% (variable)

- Credit Limit: Up to £1,500

Key Features:

- Free Eligibility Check: You can see if you’re eligible for the Ocean Finance Credit Card without affecting your credit score. The process is fast, giving you a response in just 60 seconds.

- Flexible Credit Limit: With an initial credit limit of up to £1,500, you can request credit limit increases over time if eligible. However, it’s important to remember that a higher balance could increase your interest payments and the time it takes to pay off the card.

- Multiple Cardholders: You can add up to three additional cardholders to your account, but keep in mind that you are responsible for all transactions made on the account.

- Responsible Use for Credit Building: Ocean Finance encourages users to stay below 25% of their credit limit and to always pay on time. Setting up a Direct Debit makes managing payments easier, helping you avoid late fees and keep your credit score on track.

The Ocean Finance Credit Card is a solid choice for those who need flexibility and ease of management while working towards better credit.

4. Capital One Classic Card

The Capital One Classic Card is a popular choice for those looking to rebuild their credit, with over 6 million people already accepted. It’s designed to offer easy approval without impacting your credit score, providing a practical solution for individuals with bad credit.

- Representative APR: 34.9% (variable)

- Credit Limit: £200 – £1,500

Key Features:

- Check Eligibility Without Impacting Your Credit Score: Capital One allows you to check if you’ll be accepted for the Classic Card without affecting your credit rating, making the process stress-free.

- Credit Building: By using the card responsibly—making timely payments and keeping within your credit limit—you can improve your credit score over time.

- Flexible Credit Limit: Starting at £200, the card offers credit limits that can go up to £1,500, depending on your financial behaviour and eligibility.

Capital One’s Classic Card is ideal for those who need a simple and effective way to improve their credit score while maintaining financial flexibility.

5. Thimbl Credit Card

The Thimbl Credit Card is designed for individuals with bad credit, offering a practical way to improve your credit score. Thimbl makes it easy to check your eligibility without affecting your credit score, and it provides personalised credit limits based on your affordability.

- Representative APR: 34.5% (variable)

- Credit Limit: £500 – £1,200, personalised based on your financial circumstances

Key Features:

- No Impact Eligibility Check: Thimbl allows you to check your eligibility for their credit card without leaving a mark on your credit report, making the process risk-free.

- Personalised Credit Limit: Depending on your financial situation and affordability, Thimbl offers credit limits ranging from £500 to £1,200, giving you the flexibility you need while managing your spending.

- Credit Building: By making timely payments and staying within your credit limit, Thimbl helps you improve your credit score over time.

The Thimbl Credit Card is a great option for individuals with bad credit who are looking for a straightforward way to rebuild their credit, all while keeping control over their finances.

6. Easy Loans Credit Card

The Easy Loans Credit Card is designed for those looking for a convenient way to access credit while managing their finances responsibly. Offering up to 56 days of interest-free credit, this card provides flexibility and ease of use, making it an attractive option for individuals with bad credit.

- Representative APR: 39.9% (variable)

- Credit Limit: Up to £1,500

Key Features:

- Up to 56 Days Interest-Free: Enjoy up to 56 days of interest-free purchases when you pay off your balance in full by the due date, making it easier to manage your finances without accruing high interest.

- Easy Online Application: The Easy Loans Credit Card offers a simple and fast online application process, giving you quick access to credit when you need it most.

- Credit Limits Up to £1,500: With a maximum credit limit of £1,500, this card offers flexibility for everyday spending while helping you manage your credit responsibly.

The Easy Loans Credit Card is a great option for those who want a straightforward application process, interest-free credit periods, and a manageable credit limit, all while working on improving their credit score.

7. Luma Credit Card

The Luma Credit Card is a friendly and accessible option for individuals looking to rebuild their credit, with straightforward features and an easy application process. Known for saying “YES” to applicants, Luma offers a hassle-free way to access credit, even if you’ve faced credit issues in the past.

- Representative APR: 35.9% (variable)

- Credit Limit: Up to £1,500

Key Features:

- QuickCheck for Approval: Luma’s QuickCheck tool lets you know if you’ll be accepted before you apply, without impacting your credit score. You’ll get a response in just 60 seconds, making the process fast and stress-free.

- Good for Credit Building: With no annual fee and accessible eligibility requirements, the Luma card is ideal for those looking to rebuild their credit score, even if they have CCJs or other credit issues.

- Online Account Management: Manage your account anytime, anywhere with Luma’s online portal and mobile app, allowing you to keep track of your spending on the go.

- Additional Cardholders: Streamline household finances by adding additional cardholders to your account. Keep in mind that you’ll be responsible for all transactions made by additional cardholders.

- No Hidden Charges: Luma prides itself on transparency—there are no annual fees or hidden charges to worry about.

With easy eligibility requirements and a credit-building focus, the Luma Credit Card is a great option for individuals who want a straightforward, reliable card that helps improve their financial health.

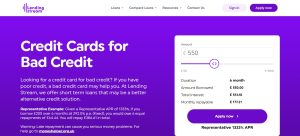

8. Lending Stream Credit Card

While Lending Stream primarily focuses on short-term loans, they also offer credit solutions for those with bad credit. If you’re looking for a card that can help rebuild your credit, the Lending Stream Credit Card may provide the support you need.

However, it’s important to note that their lending rates are much higher compared to traditional credit cards, making this option more suitable for short-term borrowing needs.

- Representative APR: 1333% (variable)

- Loan Amount: £50 – £1,500

- Repayment Term: Up to 6 months

Key Features:

- Designed for Bad Credit: Lending Stream’s credit card options cater to those with poor credit, offering an alternative for people struggling to secure credit elsewhere.

- Short-Term Loan Alternative: Lending Stream also offers short-term loans as a potential credit solution, with fixed monthly payments over a 6-month term.

- Repayment Example: Borrowing £550 over 6 months would result in monthly payments of £177.21, totalling £1,063.18.

- Warning on Late Payments: Late repayments can cause serious financial difficulties, and borrowers are encouraged to seek help from resources like moneyhelper.org.uk if they encounter repayment challenges.

The Lending Stream Credit Card comes with significantly higher interest rates than most credit cards, making it more of a short-term credit solution. It’s important to consider this option carefully and ensure that repayments can be met to avoid financial strain.

9. Drafty Credit Card

The Drafty Credit Card offers a transparent and flexible credit solution, perfect for those looking for a no-hassle borrowing experience.

With Drafty, you only pay interest on the money you use, and there are no hidden fees—ever. This makes it a practical option for individuals who want easy access to credit without the burden of extra charges.

- Representative APR: 96.2% (variable)

- Credit Limit: Up to £3,000

Key Features:

- No Fees: Drafty doesn’t charge any fees under any circumstances. Whether it’s late fees or annual fees, you’ll never have to worry about unexpected charges.

- Pay Interest Only on What You Use: One of the standout features of Drafty is that you only pay interest on the amount you borrow. If you don’t use your credit, it costs you nothing.

- Fast Approval: Drafty offers a fast decision process, and if approved, funds are transferred to your bank in under 90 seconds, providing quick access to cash when needed.

- Flexible Borrowing: Apply for up to £3,000, and once approved, withdraw as much or as little as you need up to your credit limit. You can reuse the credit line without needing to reapply each time.

Drafty’s flexibility and fee-free model make it an attractive option for those who want a transparent and accessible credit solution that fits their financial needs without the burden of unnecessary costs.

| Credit Card | Representative APR | Credit Limit | Key Features |

| Aqua Classic Card | 34.9% (variable) | £250 – £1,200 | Personalised credit limit, free credit score updates, 24/7 fraud protection. |

| Zable Credit Card | 34.9% (variable) | £300 – £1,500 | No fees, Apple/Google Pay support, eligibility check without credit score impact. |

| Ocean Finance Credit Card | 39.9% (variable) | Up to £1,500 | Quick eligibility check, add up to 3 cardholders, credit limit increases. |

| Capital One Classic Card | 34.9% (variable) | £200 – £1,500 | Easy eligibility check, helps build credit, free credit score monitoring tools. |

| Thimbl Credit Card | 34.5% (variable) | £500 – £1,200 | Personalised limits, no impact eligibility check, ideal for credit rebuilding. |

| Easy Loans Credit Card | 39.9% (variable) | Up to £1,500 | Up to 56 days interest-free, easy online application, flexible credit limit. |

| Luma Credit Card | 35.9% (variable) | Up to £1,500 | No annual fee, eligibility check, accessible for those with CCJs or poor credit. |

| Lending Stream Credit Card | 1333% (variable) | £50 – £1,500 (short-term loan) | High APR, alternative to credit cards, quick decisions, short-term loans. |

| Drafty Credit Card | 96.2% (variable) | Up to £3,000 | No fees, pay interest only on what you borrow, instant fund transfer. |

| Lending Expert Credit Card | Varies by provider | Varies by provider | Comprehensive market comparison, FCA regulated, quick eligibility checks. |

This table provides an easy reference for the key details of each credit card, helping readers quickly compare options based on their APR, credit limit, and special features.

How to Improve Your Credit Rating with a Guaranteed Approval Card?

Improving your credit score with a guaranteed approval card requires discipline and responsible usage. Here are some actionable tips to help you get the most out of your card while boosting your credit score:

- Make Payments on Time: Payment history is one of the most important factors in your credit score. Make sure to pay at least the minimum amount due each month, but ideally, pay off your balance in full to avoid interest charges. Setting up automatic payments can help ensure you never miss a deadline.

- Keep Your Credit Utilisation Low: Credit utilisation refers to how much of your available credit you are using. It’s generally recommended to keep this below 30%. For example, if your card has a £1,000 limit, aim to keep your balance below £300. This demonstrates to lenders that you can use credit responsibly without relying too heavily on it.

- Avoid Applying for Multiple Cards: Each time you apply for a new credit card, a hard inquiry is made on your credit report, which can temporarily lower your score. Focus on managing one or two credit cards well rather than applying for multiple accounts, which may suggest financial instability.

- Regularly Monitor Your Credit Report: Many credit card providers, such as Aqua or Capital One, offer free tools to help you monitor your credit score. Regularly checking your credit report allows you to track your progress, catch any mistakes, and address them promptly.

- Gradually Increase Your Credit Limit: Over time, and as you demonstrate responsible credit behaviour, you may become eligible for a credit limit increase. This can further reduce your credit utilisation ratio, helping to boost your credit score. However, avoid using the increased limit for unnecessary spending.

- Limit Unnecessary Spending: It’s easy to fall into the trap of overspending once you have access to credit. Keep purchases to essentials, especially if you’re still in the process of rebuilding your credit. This will ensure that you can make timely payments without straining your budget.

By following these steps, you’ll gradually see improvements in your credit score, making you eligible for better financial products in the future, such as lower-interest loans or premium credit cards.

Pros and Cons of Guaranteed Approval Credit Cards

While guaranteed approval credit cards can be incredibly useful for rebuilding your credit, they come with both advantages and disadvantages. Let’s take a closer look at the pros and cons:

Pros:

- Easy Approval: These cards are designed for people with poor credit, making it easier to get approved compared to traditional credit cards.

- Credit Rebuilding Opportunities: Using the card responsibly helps rebuild your credit score over time, opening the door to more financial opportunities in the future.

- Access to Essential Credit: Even with a poor credit score, you’ll have access to credit for emergencies, bills, or everyday purchases.

- Free Credit Monitoring: Many of these cards offer free credit monitoring tools to help you track your progress and stay on top of your credit status.

Cons:

- Higher Interest Rates: Guaranteed approval cards often come with higher APRs than traditional credit cards, which can lead to expensive interest charges if you carry a balance.

- Low Credit Limits: These cards generally come with lower credit limits, which can be restrictive if you need a larger amount of credit.

- Fewer Perks: Unlike premium credit cards that offer cashback, travel rewards, or other perks, these cards typically offer fewer benefits.

- Fees: Some guaranteed approval credit cards come with annual fees, late payment fees, or foreign transaction fees, adding to the overall cost of using the card.

It’s important to weigh these pros and cons before applying for a guaranteed approval card. For many people, the benefits of rebuilding credit outweigh the downsides, but it’s crucial to manage the card carefully to avoid further financial strain.

Conclusion

Guaranteed approval credit cards are an invaluable tool for individuals in the UK who are looking to rebuild their credit. With the right approach, these cards can help you improve your credit score, giving you access to better financial products and opportunities in the future.

From the Aqua Classic Card to the Capital One Classic Card, there are many options available that cater to different needs and credit histories.

By choosing the right card and using it responsibly—keeping your credit utilisation low, making timely payments, and monitoring your credit—you’ll be on the right path to financial recovery.

Whether you’re starting from scratch or recovering from past financial mistakes, a guaranteed approval credit card can be the first step toward regaining control of your credit.

Frequently Asked Questions (FAQ)

How can I check my eligibility for a bad credit credit card without affecting my credit score?

Many providers, such as Zable, Luma, and Lending Expert, offer tools that allow you to check your eligibility without impacting your credit score. These quick checks give you a decision in minutes.

Are there any credit cards with no fees?

Yes, the Drafty Credit Card offers no fees under any circumstances, and you only pay interest on the money you borrow.

Can I increase my credit limit on a bad credit credit card?

Yes, cards like Aqua Classic and Ocean Finance offer credit limit increases if you manage your account responsibly over time.

Which credit card offers interest-free periods?

The Easy Loans Credit Card provides up to 56 days of interest-free credit, as long as you pay off your balance in full by the due date.

Which credit cards are suitable for individuals with CCJs or a very poor credit history?

The Luma Credit Card offers accessible eligibility, even for individuals with CCJs or a poor credit score, making it easier to be approved.

What credit card offers the quickest access to funds?

The Drafty Credit Card provides a decision in under 90 seconds, with funds transferred to your bank almost instantly if approved.

Are there any credit card comparison tools for bad credit?

Yes, Lending Expert offers a wide credit card comparison tool, allowing you to check your eligibility for multiple cards at once, improving your chances of finding the right card for your needs.